Condo Insurance in and around Camas

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Would you like to create a personalized condo quote?

- Washington

- Oregon

- Idaho

- Texas

Home Is Where Your Heart Is

Being a townhome owner comes with plenty of worries. You want to make sure your condo and personal property in it are protected in the event of some unexpected damage or mishap. And you also want to be sure you have liability coverage in case someone gets hurt on your property.

Here's why you need condo unitowners insurance

Condo insurance that helps you check all the boxes

Agent Jeremiah Stephen, At Your Service

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance protects more than your condo's structure. It protects both your condo and your precious belongings. If your condo is affected by a fire or vandalism, you may have damage to some of your possessions beyond damage to the townhouse itself. Without adequate coverage, you might not be able to replace your valuables. Some of the things you own can be covered if they are damaged even if you take them outside of your condo. If your bicycle is stolen from work, a condo insurance policy might help you replace it.

If you want to find out more information, State Farm agent Jeremiah Stephen is ready to help! Simply contact Jeremiah Stephen today and say you are interested in this terrific coverage from one of the top providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Jeremiah at (360) 695-4408 or visit our FAQ page.

Simple Insights®

Fixed rate mortgage vs. adjustable rate mortgage

Fixed rate mortgage vs. adjustable rate mortgage

Learn the differences between a fixed rate mortgage vs an adjustable rate mortgage in order to make your decision.

What are the different types of insurance?

What are the different types of insurance?

You've probably heard of car insurance, homeowners insurance and life insurance. Find out what's covered under these and other types of policies.

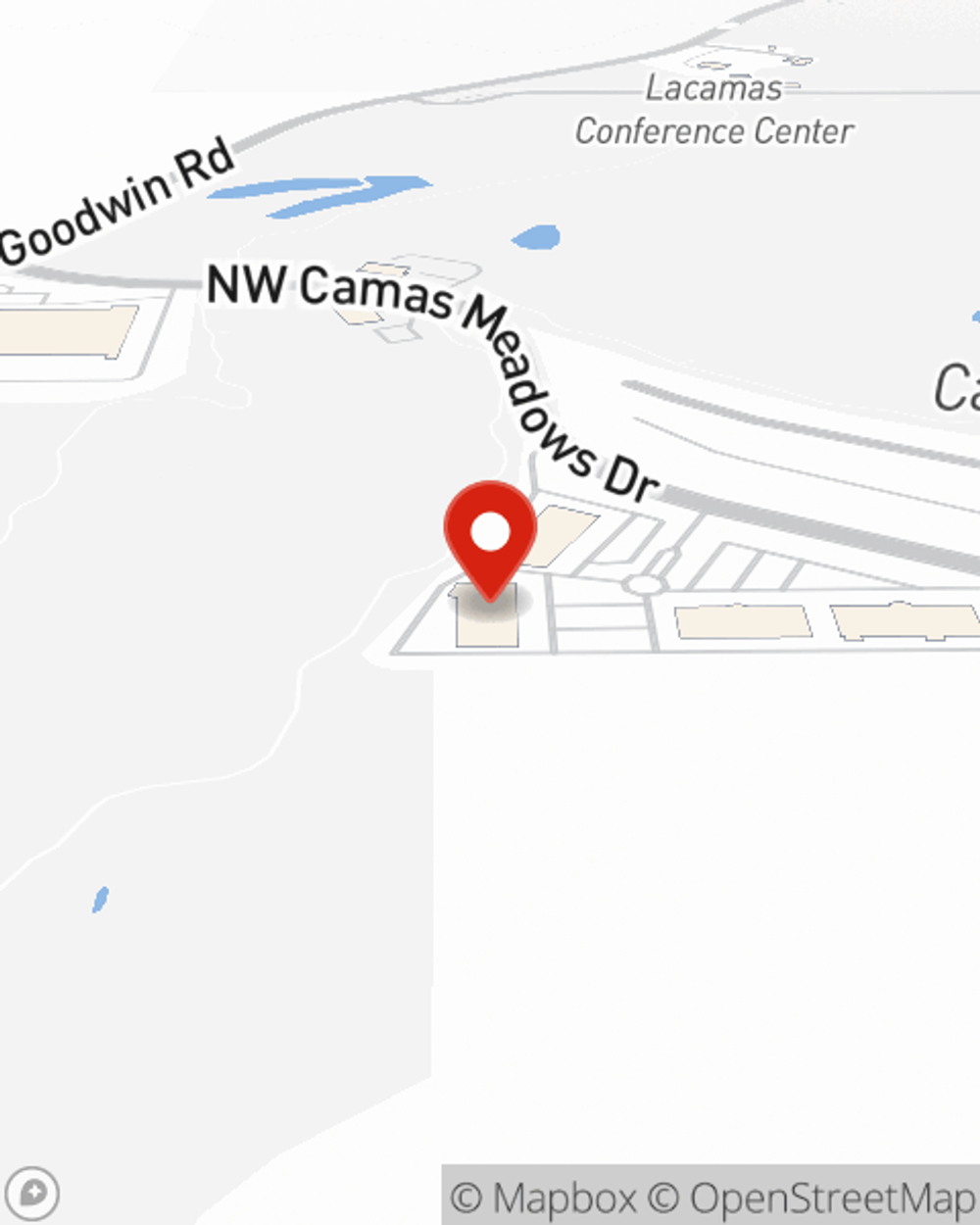

Jeremiah Stephen

State Farm® Insurance AgentSimple Insights®

Fixed rate mortgage vs. adjustable rate mortgage

Fixed rate mortgage vs. adjustable rate mortgage

Learn the differences between a fixed rate mortgage vs an adjustable rate mortgage in order to make your decision.

What are the different types of insurance?

What are the different types of insurance?

You've probably heard of car insurance, homeowners insurance and life insurance. Find out what's covered under these and other types of policies.